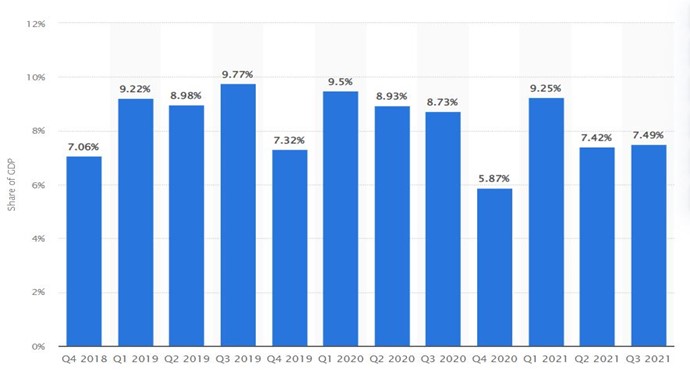

Nigeria is the largest oil and gas producer in Africa and its economy and budget has been largely supported from income and revenues generated from the petroleum industry since 1960. Recent report by Statista stipulates that as of February 2021, Nigeria’s oil sector contributed to about 9% of the entire country’s GDP. This article provides an appraisal of the position of the NIGERIAN OIL AND GAS Sector (the “Sector”) viz-a-viz the African Continental Free Trade Area (AfCFTA).

THE NIGERIAN OIL AND GAS SECTOR

Nigeria is one of the largest and oldest oil producers in Africa. The oil and gas sector is one of the most important sectors in the country’s economy, accounting for more than 90% of the country’s exports and 80% of the federal government’s revenue. Nigeria is one of the largest countries in terms of proved oil and gas reserves in Africa. As of 2020, proved crude oil and natural gas reserves in Nigeria reached 86.9 million tons and 49.4 billion cubic meter (bcm). The country produces low-sulfur content crude oil, which has a high global demand pertaining to the need for reduction in sulfur content in the products processed by the worldwide refiners.

The demand for the crude oil produced in Nigeria, which has low sulfur content, is expected to rise sharply during the studied period as the global shipping industry adapts to the International Maritime Organization’s new 0.5% global bunker sulfur cap, which came into force on January 1, 2020. The Nigerian upstream market is expected to get significant investment, owing to increased demand for low sulfur content crude with IMO implications coming into effect. Also, a few recent developments are likely to add to the growth of the market. For instance, in November 2020, FIRST E&P and state-owned Nigerian National Petroleum Corporation announced that the Oil production from Nigeria’s Anyala West field, located in the shallow offshore blocks of OML 83 and 85, had commenced.

The country is the ninth largest in terms of global gas reserves, with over 193.3 Tcf, but it has not started up any new gas projects recently. As of 2020, Nigeria had the largest oil and gas reserves in the African region, with around 37 million barrels of crude oil (36,910) and 5.5 trillion cubic meters of gas. The country plans to become an export hub in Africa by exporting not only to regional countries but also to other Asian countries, like India and China, where the gas demand is anticipated to increase in the coming years. Furthermore, the country has significant domestic demand for gas, mainly from the power sector. The gas-fired power plants in the country are consistently under-utilized due to the lack of an uninterrupted gas supply. The country also has a potential domestic demand from the commercial, residential, and industrial sectors. By building the country-wide gas distribution network, the Nigerian government aims to tap into this potential.

President Muhammadu Buhari IN 2021 signed the Petroleum Industry Act (PIA) 2021, bringing to a close a 20-year effort to reform Nigeria’s oil and gas sector, with the aim of creating an environment more conducive for growth of the sector and addressing legitimate grievances of communities most impacted by extractive industries. The PIA represents an effort by Africa’s leading oil-producing country to respond to this changing environment. If properly and vigorously implemented, the PIA can represent the gold standard of natural resource management, with clear and separate roles for the subsectors of the industry; the existence of a commercially-oriented and profit-driven national petroleum company; the codification of transparency, good governance, and accountability in the administration of the petroleum resources of Nigeria; the economic and social development of host communities; environmental remediation; and a business environment conducive for oil and gas operations to thrive in the country.

AFCFTA AND THE NIGERIAN OIL AND GAS SECTOR

Oil and gas and mineral resources account for more than 75% of Africa’s exports, and the continent’s potential for growth in oil & gas is significant. Estimations at the end of 2017 indicated that Africa has 487.7 tcf of proven gas reserves (7.1% of proven global reserves), while Africa’s proven oil reserves are in the region of 125 billion bbl. Nigeria has oil and gas as her major source of revenue, accounting for more than 80% of her foreign exchange, with the AfCFTA taking away tariffs on goods and services produced across the continent irrespective of the market where it’s been sold. The AfCFTA being the second largest free trade agreement in the history of World Trade Organization, in effect presents the much-needed platform for intra-Africa trading which particular benefits Nigeria as the largest exporter of crude oil.

Nigeria has already set its intentions on becoming the largest oil refining hub on the continent. The AfCFTA will facilitate trade and the evolution of existing commerce lines within Africa and not necessarily radically revolutionize the space. However, in sectors like oil & gas, where corruption is rampant, this evolution will be crucially determined by transformations of existing governance structures and infrastructure. Furthermore, the AfCFTA will trigger substantial investment in the oil and gas industry from countries overseas such as the United States and other European countries, mainly because the AfCFTA changes investors’ value proposition by providing a larger market with lower risk.

The AfCFTA expands the market by providing a single market with reduced cross-border barriers; investors can thus undertake larger revenue projects on a regional scale rather than a national scale. Before AfCFTA, approximately 25% of all intra-African exports in 2017 were for oil, gas, and electrical energy. With the effectiveness of the AfCFTA, the economies of scale are available for regional power solutions, Africa can reasonably expect the power export market to expand markedly. The anticipated prospect of regional power solutions is already attracting increased investment in African power projects, which would have been unfeasible before AfCFTA.

As part of efforts in building bridges for a successful AfCFTA, the Nigerian National Petroleum Corporation (NNPC) sometime in November 2021 signed a five-year agreement worth $1.04 billion with the African Export–Import Bank (Afreximbank) at the Intra-African Trade Fair in Durban, South Africa. Although the NNPC and Afreximbank deal does not involve exploration of crude oil, the same is mainly for trade financing and export of the crude produced by the national oil company.

In conclusion, the AfCFTA remains an excellent platform, not only for the Nigerian oil and gas industry, but for African commerce at large. The benefits of improved efficiency on the continent and encouragement of competition on the oil and gas markets will be significantly felt on the continent and would boost development.

Reference(s)

1. Petroleum Industry Act (PIA) 2021

2. Mordor Intelligence (Online Link)