The board of directors play a crucial role in piloting a company’s affairs. Anthony (2018) explains why corporate governance specialists advocate for diversity on the board to include bringing together persons with varying skillsets and perspectives, who altogether help the company make sound business decisions, leading to lower volatility and better performance. Some authors including Stephanie Creary have expressed this in terms of social (race, nationality, gender, age) and professional diversity, all of which enhances a rich diversity of perspectives and avoids groupthink.

Put differently, boardroom diversity is a prospect to endorse heterogeneity by considering crucial factors such as gender, ethnicity, belief, sexual orientation, race, age, educational background, socio-economic grouping, professional qualifications, abilities or in-capabilities of the directors. While diversity in some jurisdictions would be considered, essentially, the focus of this article is boardroom diversity in the Nigerian corporate scheme.

Board Diversity

One way of enhancing corporate governance is to diversify the board. Diversity means having a range of many people that are different from each other. Categories of diversity might include age, race, gender, educational background, professional qualification, experience, personal attitudes, marital status and religion. Board diversity aims to cultivate a broad spectrum of demographic attributes and characteristics.

In the year 2020, it was reported that the United Kingdom (“UK”) through corporate governance report and codes adopted a voluntary gender diversity target ratio of 33% and continuously strives to achieve the target ratio (Hunt, Prince, Dixon-Fyle & Yee, 2018). Otherwise, the UK corporate boards must give details in their annual reports, the reasons for non-compliance and the necessary procedures to be taken in consideration to the targeted ratio and in order to effect compliance (Gordon, 2018).

In the Canadian corporate sphere, Amy Minsky reports that diversity is equally a prominent issue. Comply or explain diversity requirements have been required for issuers listed on the Toronto Stock Exchange since December 31, 2014 (MacDougall, 2018). The Canadian Board Diversity Council in 2018 reported that institutional investors have also been active in pushing for the entrenchment of the diversity principle on boards and regularly push against the appointment of all-male boards. This has consequently led to a slight increase in the percentage of women who seat on corporate boards comparative to men.

Board Diversity In The Nigerian Corporate Sphere

In Nigeria, Principle 2 of the Nigerian Code of Corporate Governance (NCCG) 2018 seeks to ensure that companies pay attention to issues relating to board diversity. The Code recommends the following practices for the composition of a well-rounded board:

- The board should be of a sufficient size to effectively undertake and fulfil its business; to oversee, monitor, direct and control the company’s activities and be relative to the scale and complexity of its operations.

- The board should promote diversity in its membership across a variety of attributes relevant for promoting better decision-making and effective governance. These attributes include field of knowledge, skills and experience as well as age, culture and gender. The board should have a policy to govern this process and establish measurable objectives for achieving diversity in gender and other areas.

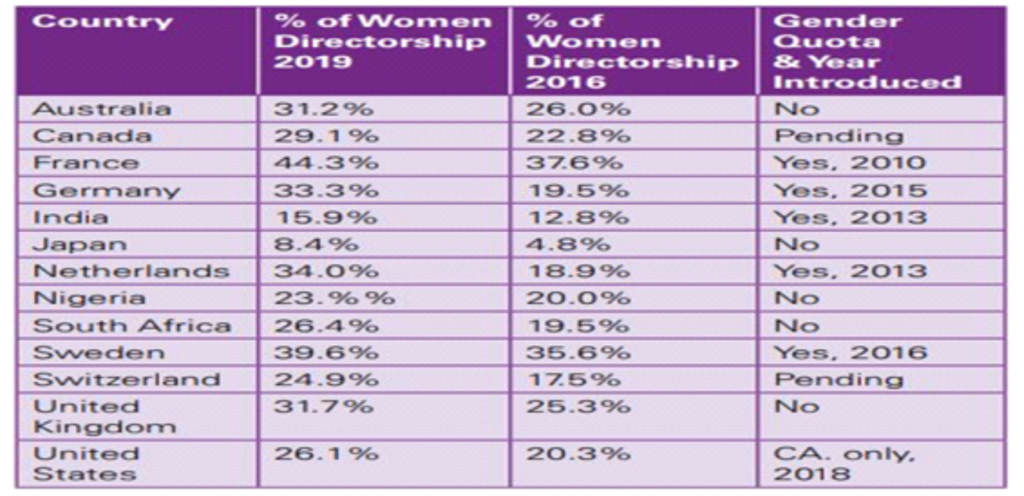

Although boardroom diversity is increasing across the globe, KPMG reports that women on boards are still underrepresented and the progress is slow. On a global basis, women hold less than 20% of board seats among companies listed on the Morgan Stanley Capital International All Country World Index (MSCI ACWI), a global equity index. According to Egon Zehnder, 2020 Global Board Diversity Tracker, 23.3% of board positions are now held by women globally, up from 20.4 % in 2018.

Women’s Global Representation on Boards as at 2019. (Source: KPMG – Women on Boards)

While there are no specific legal requirements for gender diversity (i.e. Quota) in the Nigerian legal system except for regulations issued by the Central Bank of Nigeria (CBN), the Securities and Exchange Commission (SEC) Code of Corporate Governance, and the Nigerian Code of Corporate Governance, 2018 (NCCG). CBN regulations mandate a minimum of 30 percent female representation on boards of Nigerian commercial banks, the SEC Code recommends that publicly listed companies consider gender when selecting board members, and the NCCG encourages the board to set diversity goals and to be mindful of them when filling board vacancies.

Taking gender diversity for example, in Nigeria, with a population of over 200,000,000 and a Gross Domestic Product (GDP) of about 432.3 billion USD (2020), Nigeria number of women that make up as Chief Executive Officers on listed companies is astonishingly few when compared to the number of men.

Source: The Boardroom Africa

Benefits of Board Diversity

The benefits of boardroom diversification cannot be overemphasized. It follows that diversifying the board should have the following benefits:

- A diverse board should help reduce ‘groupthink’ and hence result in more objective decisions being made. Groupthink describes the tendency of a group to make collective decisions that minimize conflict rather than critically evaluate alternatives.

- Diversity should help the board approach problems from a greater variety of perspectives and raise challenging questions resulting in a more vigorous debate.

- It appears the search for non-executive directors (NEDs) has been restricted to male candidates with similar backgrounds to existing members of the board. Broadening the target population by diversifying candidate profiles will foster better use of the available talent pool.

- Employing a diverse board is a positive signal to both internal and external stakeholders that the company does not discriminate against minorities.

Boardroom diversity remains an important topic because it is one of the ways in which corporate performance and governance of a company can altogether be improved. Diversity can be promoted in several ways including through the imposition of quotas which would force organizations to address barriers to diversity. Also, an unbiased implementation of corporate governance codes that require companies to disclose their diversity policy and compliance therewith is crucial to the attainment of board diversity.

References:

- Nigerian Code of Corporate Governance (NCCG) 2018.

- Anthony Garcia, “Director Skills: Diversity of Thought and Experience in the Boardroom”, (10 October 2018), online: Harvard Law School Forum on Corporate Governance and Financial Regulation.

- Stephanie J Creary et al, “When and Why Diversity Improves Your Board’s Performance”, Harvard Business Review (27 March 2019), online.

- Gordon S. UK Plc. behind Target for Number of Women on Boards. Financial Times, 2018, online.

- Amy Minsky, “Gender Quotas: Who Else Has Them and Does Canada Need Them?”, (28 October 2016), online.

- Andrew MacDougall, Robert Yalden & John Valley, “Canada” in Willem J L Calkoen, ed, The Corporate Governance Review, 8th ed (Law Business Research Limited, 2018).

- ARC Annual Report Card 2018 (Canadian Board Diversity Council, 2018).

- KPMG – Women on Boards, online.