In this edition, we will take a look at “The AfCFTA and The Nigerian Creative Industry.”

No global economy viz-a-viz Nigerian businesses can optimally operate without an efficient machinery for driving a competitive business environment. The Nigerian business environment is divided primarily into the public and private categories and these categories are further divided into various industries including the trading industry, real estate industry, manufacturing industry, and creative industry, amongst others. This article analyses how the Nigerian creative industry can take advantage of the African Continental Free Trade Area (AfCFTA) to drive competitiveness for Nigerian businesses.

THE NIGERIAN CREATIVE INDUSTRY

The fact that Nigeria has one of the biggest creative industries in the world is not contested. With millions of youths across the 36 municipals in the country, Nigeria is not only blessed with natural resources but also with human capital and talents. The Nigerian creative industry comprises of industries such as music, fashion, gaming, film/TV, plays, books, amongst others.

PwC’s Spotlight on the Nigerian film industry reported that the Nigerian Film Industry (Nollywood) is in fact the second largest movie industry globally – in terms of output, producing about 2,500 films in a year. This number surpasses Hollywood and is second only to India’s Bollywood. PwC reports that the industry is a significant part of the Arts, Entertainment and Recreation Sector which contributed 2.3% (NGN239biliion) to Nigeria’s Gross Domestic Product (GDP) in 2016. It is one of the priority sectors identified in the Economic Recovery and Growth plan of the Federal Government of Nigeria with a planned $1billion in export revenue by 2020.

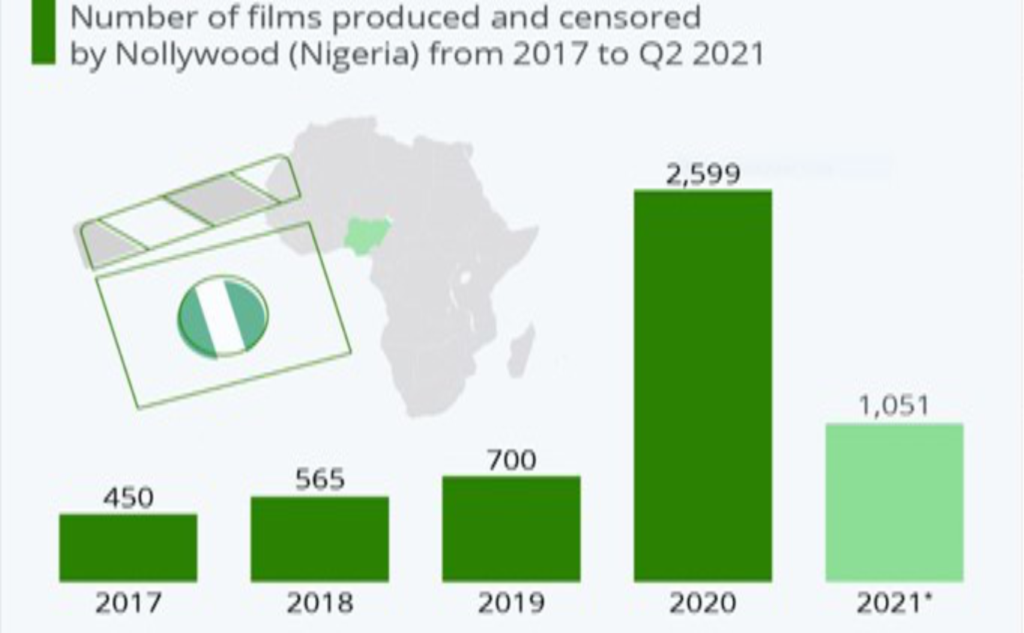

In a recently published report by Statista, 2019 saw a grand total of 700 films produced and censored, but as this infographic shows, that is nothing compared to the numbers being put down in 2020 and 2021 and according to the Nigerian National Bureau of Statistics, 2020 saw a massive 2,599 movies completed and the first half of 2021 shows a similar level of activity in the industry – 1,051 films were produced and censored by the end of Q2.

This chart shows the number of Nollywood films produced and censored from 2017 to 2021

Source: Statista.com

The music sector of Nigeria’s entertainment industry also recorded significant growth over the years. Stakeholders include artists, musicians, producers, promoters, managers, distributors, and marketers. In the past six years, the growing numbers of new production studios and artists enabled a more vibrant and self-sustaining industry. The investments have aided production of world-class quality music. In this environment, Nigerian musicians have developed a vast spectrum of music genres.

AFCFTA AND THE NIGERIAN CREATIVE INDUSTRY

The Nigerian film industry (Nollywood) is the second-largest film sector globally, surpassing even the United States and the third most profitable, with a $5.1 billion valuation in 2013. Nigeria cinema accounted for five percent of the country’s gross domestic product (GDP). The latest Nigerian Nollywood movies and TV shows have gained global viewers thanks to distribution deals with Western streaming services. By implication, the Nollywood can explore ways of applying its Intellectual Property within the AFCFTA framework to generate revenue as a leading force in the African creative industry.

According to a CNN report by the United States International Trade Commission (USITC), Nollywood, the Nigerian film industry: currently employs over 1 million people, is the second largest employer in Nigeria after agriculture and the Federal Government, generates approximately $600m/annum for the Nigerian economy, releases an average of 50 movies/week which show in cinemas, online and on cable, etc. and has the second largest revenue in the world after Bollywood.

The fashion industry is based on the design, manufacture and distribution of physical goods/products (i.e., clothing, footwear and accessories etc.). For Nigerian businesses, this means the cost of selling Nigerian-made fashion goods in other African countries would ordinarily make such items less competitive in these countries in terms of price, due to associated import tariffs. The AfCTA, by eliminating tariff barriers between African countries, should therefore have a positive effect on the fashion industry by opening new territories across the continent for Nigerian-made clothing and accessories – that would no longer be ‘overpriced’ when compared to local equivalents in these markets.