Welcome to our African Continental Free Trade Area (AfCFTA) Newsletter. In the previous edition, we started a discussion on “Regional Economic Communities and the AfCFTA”. We listed the various RECs that are recognized by the AfCFTA and how they are related. In this edition, we would discuss extensively one of the RECs and how it relates to AfCFTA.

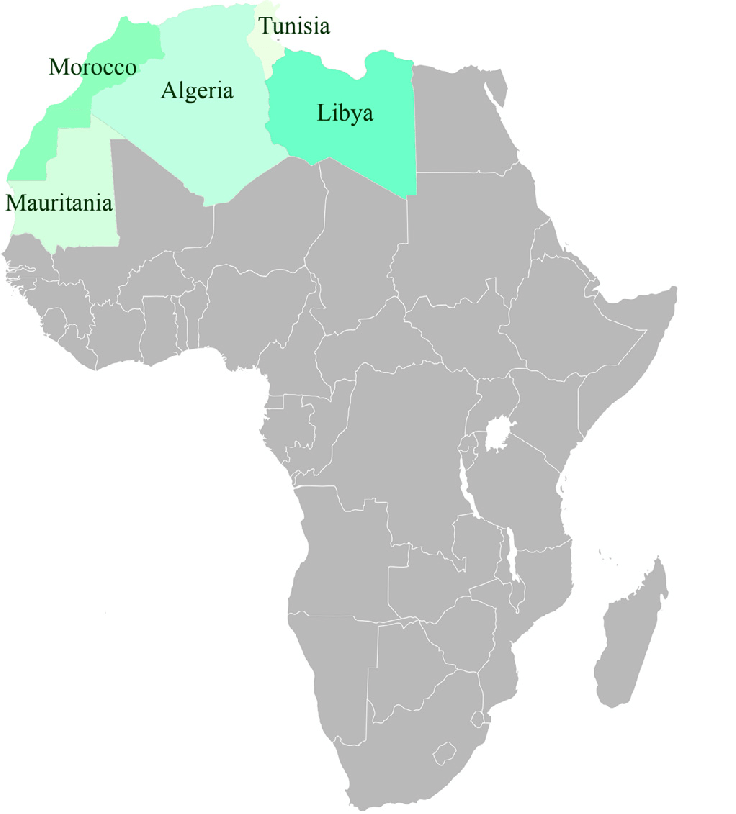

The Arab Maghreb Union (UMA) was established in February 1989 under the Marrakech Treaty. It is one of the eight officially recognized African Regional Economic Communities. It currently has five members and includes Algeria, Libya, Mauritania, Morocco, and Tunisia, all of which are predominantly Islamic States in Northern Africa.

The Arab Maghreb Union

The primary purpose of the UMA includes:

1. Strengthening ties between the five member states

2. Promoting prosperities across the member state

3. Defending the member states national right

4. Adopting common policies to promote the free movement of people, services, goods, and capital within the region.

The Member States can be classified into two broad categories: countries that pursue a liberal trade policy (Morocco and Tunisia) and countries in which the government exercises a monopoly over trade (Algeria and Libya). Mauritania which is the fifth member state is unique as it is the least developed country and one in which the Government encourages private initiative while at the same time it exercises strict control over the foreign exchange.

Despite the differences between the five member states, they face the same international pressure, and they are characterized by the same structural features. Algeria and Libya have also implemented structural reform to lessen the Government’s grip on external trade and to enable those in the private sectors to carry out transactions freely.

In 2019, representatives of the five member states took part in a seminar on the potential impact of the AfCFTA on the Maghreb Economies. The seminar aimed to encourage a better positioning of Maghreb economies in the building of the African single market. The participants agreed on

1. The crucial role of the private sector in the regional integration process and the need for mechanisms enabling it to contribute to the AfCFTA’s success in the sub-region

2. The need to strengthen financial systems’ support for import and export activities

3. The need to pay greater attention to non-tariff barriers, which are the main obstacles to trade across the sub-region

The UMA effort for economic development has been to look outward, first at the European Union (EU) and thereafter select Arab and sub-Saharan countries for trading partners, rather than their immediate neighbors. AMU countries are focused on building closer economic ties and deepening cooperation with a variety of European and Arab-led initiatives.

This has discouraged efforts to deepen integration amongst themselves. Competing domestic interests and higher economic gains outside the region, combined with political deadlocks amongst UMA members, have resulted in neglect of regional integration efforts within the Maghreb Union.

Despite these challenges, the AU identifies the UMA as one of the building blocks to drive the AfCFTA continental vision for integration. The AfCFTA came into force to reduce tariff barriers and harmonize trade rules between member countries with a view to reducing transaction costs and promoting intra-regional trade in goods and services. According to the Economic Commission for Africa (ECA), an estimation was made that AfCFTA implementation is expected to lead to an increase of more than 60% in intra-continental trade.

In comparison with the Non-Member states, Member states of the Maghreb union could benefit more from the implementation of the AfCFTA due to the fact that they possess: economic complementarity, opportunities for the creation of sub-regional value chains, higher quality of transport infrastructure, a well-trained workforce, a common language, and proximity to the Euro-Mediterranean area. If the AfCFTA is implemented along with trade facilitation, projections show that Northern African industrial trade (which constitutes the union) could grow up by 70% (about $7.1 billion worth of trade within North Africa, and about $6.5 billion worth of trade between North Africa and the rest of Africa).

Currently, the Maghreb is the least integrated sub-region. Intra- regional trade amongst Maghreb countries accounts for only 5% on average. In 2017, intra-AMU trade accounted for only 2.7% compared with 3.1% in 2016 which shows a decline. This is largely the result of poorly coordinated trade liberalization strategies, weak commodity prices, and the application of high tariffs to intra-UMA imports.

Greater industrialization and manufacturing capacities will enhance Maghreb’s competitiveness at a global level and can help support the AfCFTA goal of creating a single market. Supporting the AfCFTA visions will enable Maghreb countries to build trade complementarities across an entire community.

In conclusion, the AfCFTA should be seen as an opportunity to enhance already ongoing engagement between the UMA countries. Deepening economic relations can be greatly advanced by business chambers and private sector associations playing a stronger role in fostering countries’ relationships. This will advance business relationships through continued dialogue, enable industry-level cooperation, share best practices, and encourage intra-African investment.

Reference(s)

- “UMA countries urgently call for Maghreb consultation around AfCFTA”. United Nations Economic Commission for Africa, accessed 8th September 2022.

- “AMU – Arab Maghreb Union”. United Nations Economic Commission for Africa, accessed 8th September 2022.

- “Regional Economic Communities (RECs)”. The African Union Commission, accessed 9th September 2022.

- “ECA and UMA examine potential impact of AfCFTA on Maghreb economies”. United Nations Economic Commission for Africa, accessed 10th September 2022.

- “Regional Integration for the Arab Maghreb Union: Looking Beyond the Horizon”. Konrad-Adenauer-Stiftung, accessed 12th September 2022.

- “Geographic localisation of the five Maghreb countries”. ResearchGate, accessed 12th September 2022.