The Pan-African Payment and settlement System (PAPSS) was launched on Thursday, January 13, in Accra, Ghana, in a virtual event tagged “Connecting Payments, Accelerating Africa’s Trade”.

It was developed by the African Export-Import Bank (Areximbank) and is a cross-border financial market enabling payment transactions across Africa. Its aim is to boost intra-African trade by facilitating payment, clearing, and settlement of cross-border trade within Africa. The launch of PAPSS came after a successful pilot in the West African Monetary Zone which includes the following countries: Gambia, Ghana, Guinea, Liberia, Nigeria, and Sierra Leone. The System intends to reduce the cost of cross-border transactions, thereby making payments easier for businessmen.

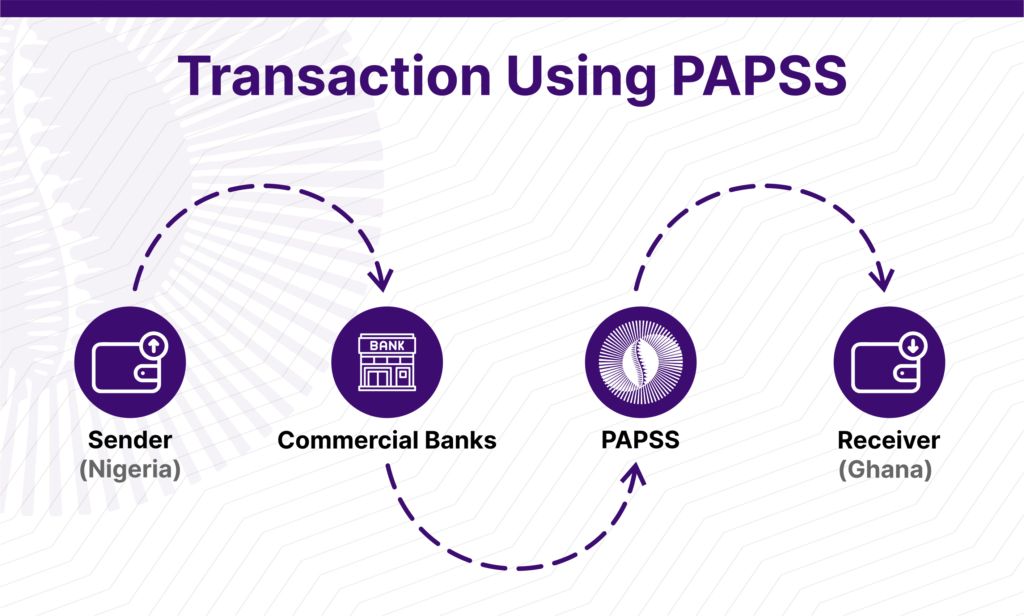

With the system, there is an assurance that payment for goods and services between two individuals from different countries will no longer be stressful, and there won’t be any need for a change in currency while trying to trade when the Pan-African Payment and Settlement System stands as the intermediary while trading,

The Pan-African Payment and Settlement System is a single payment infrastructure whose aim is to allow cross-border transactions to ensure ease and safety while transacting. The System guarantees smooth, cheap, and instant trading between African countries compared to the previously known traditional method.

With this system, you no longer need to convert your money to Dollars (the most recognized foreign exchange currency) before converting to the country’s currency to enable trading with another African. What Pan-African Payment and Settlement System does is to create a single market where payments are made in your local currency through your bank which in turn liaises with your central bank to make the payment through the System where it is eventually converted into the local currency of the receiver.

What the Pan-African Payment and Settlement System is not

- It is not just for buying but for all kinds of activities.

- It does not work outside authorized commercial banks

- It is not a platform for competition with commercial banks.

Benefits of The Pan-African Payment Settlement System to AFCTA

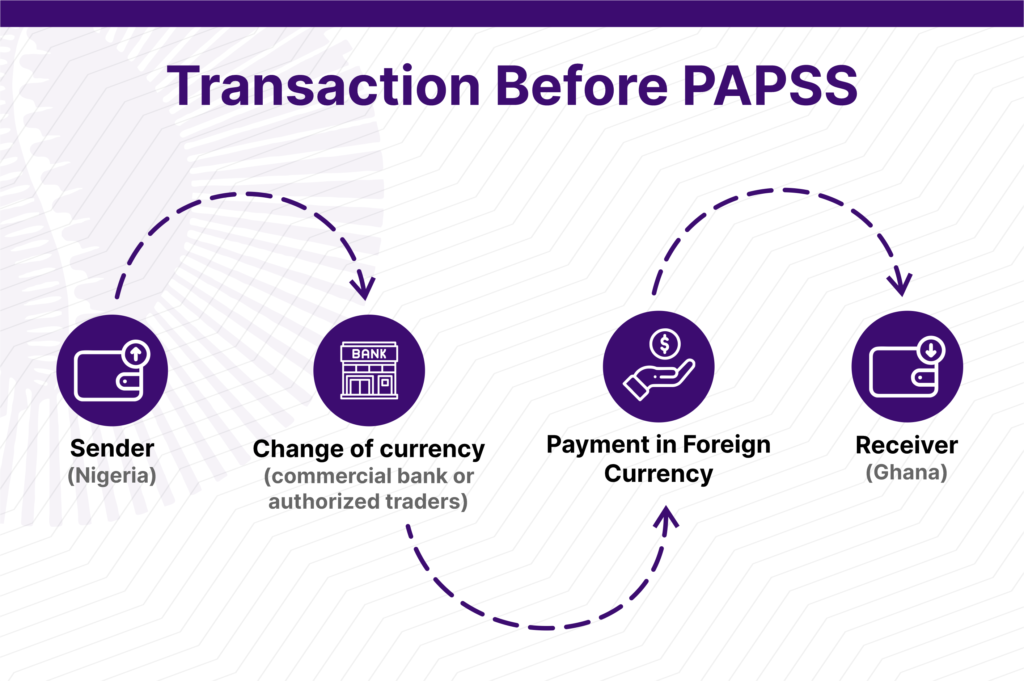

Before the launching of the Pan- African Payment Settlement system, trade was a bit difficult. Payments took a longer time to process because they involved a third-party conversion. Which was from the local currency to a universally accepted currency then to the recipient’s currency.

And even with the above, it would still take a couple of days before the trade will be finalized which discouraged a lot of transactions and mounted so much pressure on the Central Banks.

The launch of The Pan-African Payment Settlement System was to end these inconveniencies and make trade swift and stress-free.

Below are some of the benefits of the Pan-African Payment and Settlement System to the AfCFTA

- Payments will be made on the same day: transactions will no longer take days before being completed. The moment payment is made in less than no time the recipient receives proof of payment.

- There will no longer be a need for currency conversion: The Pan-African Payment Settlement System, becomes the intermediary between both countries, and the conversion and verification are done by them.

- Ease of trade will become possible within the continent: Trade between the continent will increase rapidly, people can now buy and sell their goods from one African country to another without the fear of high cost.

- The reduction in the high cost of production.

- Increase in employment

- Reduction of workload on the Central Banks.

- Reduction in cost in cross-border trade.

- It provides ease of business.

According to the Chief Executive Officer, Micheal Ogbalu, the security system of the Pan-African Payment Settlement System has been tested and trusted at both the Design and the Operational level. It has also been open to third-person checkers and has been proven to be the best.

Conclusion:

The Pan-African Payment Settlement System is a good plan for easing trade within the continent. Payments between two African countries will be made easier and cross-border relationships will become stronger.

The African Continental Free Trade Agreement Act FIND IT HERE

The Pan-African Payments and Settlement System (PAPSS)

PAPSS is a centralised payment and settlement infrastructure for intra-African trade and commerce payments. This project which is being developed in collaboration with the African Export-Import Bank, Afreximbank will facilitate payments as well as formalise some of the unrecorded trade due to prevalence of informal cross-border trade in Africa… READ MOREUnderstanding the pan-African payment and settlement system (PAPSS) of the Afreximbank

The AfCFTA aims to bring together the 54 African countries to trade under a single market with liberalised tariffs and the elimination of the non-tariff barriers to cross-border trading. However, one of the problems which had hindered intra-African trade for a long time has been the reliance on third currencies- US dollars, Euros and the British Pounds for the clearing and settlement of cross-border payments and transactions which in turn leads to high costs and long transaction times… READ MOREUnderstanding the hype around PAPSS and how it works

The dream of an integrated market in Africa seems to be coming to reality with the recent introduction of the Pan-African Payment and Settlement System (PAPSS)PAPSS is a game-changer when it comes to trade in Africa. A participant in one African country pays in their currency, while a seller in another country receives payment in their currency… READ MORE