The Nigerian Startup Bill (“The Bill”) is a development that is expected to improve business environment for Startups in Nigeria upon its passage into law. Its primary purpose is to create a positive environment for Startups by the provision of incentives, upliftment of regulatory limitations, and to develop a conducive tech ecosystem for Startups to flourish. Outlined, below, are a few of the key provisions proposed by the Bill.

Defining Startups

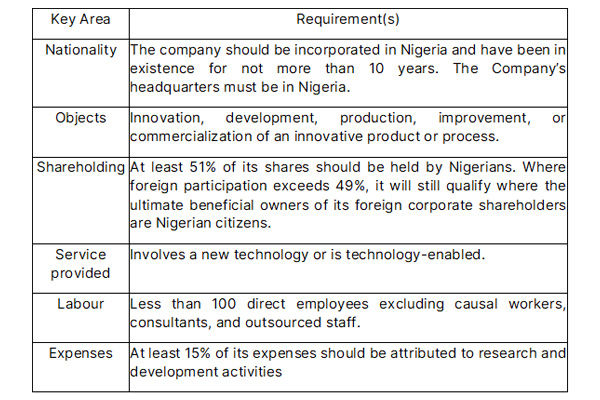

The Bill defines Startups as innovative companies whose portfolio fall within the categories listed below:

The Bill requires companies that meet the above eligibility criteria to apply for registration with the One Stop Shop Centre (OSSC) to have access to the specific incentives provided under the Bill. The OSSC is made up of representatives of regulatory agencies relevant to Startups in Nigeria such as the: Corporate Affairs Commission (CAC), Central Bank of Nigeria (CBN), National Office for Technology Acquisition and Promotion (NOTAP), Securities and Exchange Commission (SEC), Trademark, Patents and Design Registry; and a host of other regulators. All eligible companies will be required to register with OSSC through its Portal. This will serve as a platform for interaction and exchange of information between Startups and regulators.

Incentives and protections available to registered Startups under the Bill: As a progressive step, the Bill seeks to establish the National Council for Digital Innovation and Entrepreneurship (” The Council”) which is solely responsible for collaborating with various regulators and is to ensure Startups are provided all necessary support and are given the incentives accruing to them by virtue of their status. Below are some of the proposed incentives and support services.

1. Provision of regulatory support by the OSSC – In a bid to minimize the frustrating regulatory hurdles Startups tend to face, key regulators like the CAC, CBN, Trademarks, Patent and Design Registry, NOTAP; are to set up information desks at the OSSC with professional personnel, and to provide support to Startups through the OSSC Portal.

2. Provision of discounts – Regulators will be required to grant discounts on their licensing /registration fees to Startups. We expect that more details on the discounts will be included upon further review of the Bill.

3. Expedition of licence applications for Fintech Startups – The Bill requires the CBN and SEC to ensure that the license application process for Startups is expeditious and seamless. The Bill, however, does not provide clarity as to how this will be achieved or how to measure the effectiveness of the regulators in this area.

4. Provision of tax incentives to Startups- The Bill proposes tax incentives such as:

a. tax exemption on the profits of Startups for 7 years;

b. taxation of goods and services supplied by Startups at a reduced-Value Added Tax rate of 3%;

c. provision of tax credit to Startups that create a minimum number of jobs (the minimum number is to be determined by the Council).

5. Provision of tax incentives to employees of Startups and their investors.

6. Provision of funding to Startups – The Bill proposes the establishment of a Startup Investment Seed Fund to provide funding to early-stage Startups that meet the criteria set by the Council.

7. Procurement of technology-related goods and services by government parastatals – The Bill proposes that Ministries, Departments, and Agencies of the Government set a 15% margin of preference in favour of Startups when procuring technology related products.

Conclusively, the introduction of the Bill is a step in the right direction in creating an enabling environment for Startups to thrive in Nigeria. It is, however, expedient to note that the test of the effectiveness of any law such as this highly depends on the ability of the stakeholders to enforce it. It is expected that as the Bill undergoes legislative review, it would be updated to include practical provisions and guidelines that would ensure the implementation of the proposed incentives and support to Startups.

Reference(s)

- Nigeria Startup Bill. NSB

- “The Nigerian Startup Bill Corporate and Company Law-Nigeria”. Mondaq, accessed 8th July 2022.

For further discussion and assistance with filing any of your organization’s compliance returns to the Corporate Affairs Commission, as well as providing you with Board Evaluation and Nominee services, please contact us at contact@firstfiduciary.ng or any of the team member below:

Mercy Edukugho-Aminah

mercy.aminah@firstfiduciary.ng

+234 803 726 5961

Dieko Yemi-Lebi

dieko.yemi-lebi@firstfiduciary.ng

+234 908 828 5376