Understanding the Probate Process and Exploring Probate Avoidance Methods

What is Probate?

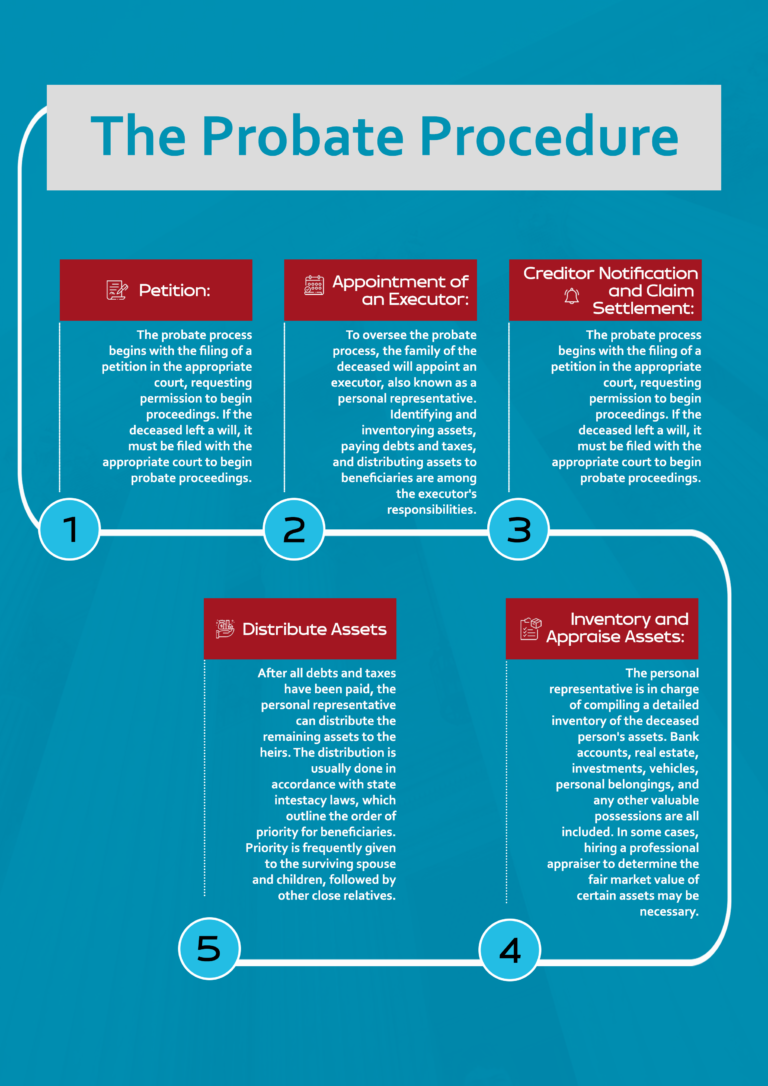

Probate is the legal process by which a deceased’s assets, including bank accounts, real estate, and financial investments, are distributed. While probate is an important part of estate administration, it can be time-consuming and costly, placing emotional and financial strain on the deceased’s loved ones. Fortunately, there are several probate avoidance techniques that individuals can use to streamline asset transfers and minimize associated complications.

In this article, we will delve into the probate process and explore practical probate avoidance strategies.

The following forms or documents would be required for the grant of probate:

- Application for grant of probate of the will.

- Declaration on oath by the executors.

- Bank certificate.

- Proof of identity of the applicant.

- Proof of identity of the deceased.

- A duly completed inventory of assets of the deceased.

- Passport photographs of the executors and witnesses to the will.

Probate Avoidance Techniques

Probate costs include filing fees, newspaper publication fees, and attorney fees. It will take anywhere from six months to two years for the average estate. Additionally, probate also makes the deceased person’s finances public knowledge. This includes the assets’ nature and value, the person’s debts, and the beneficiaries’ identities.

To avoid probate, individuals can employ the following methods, considering their specific circumstances:

- Revocable Living Trust: Establishing a revocable living trust is an effective way to avoid probate. This involves transferring assets into the trust while the individual (grantor) is still alive. After the grantor’s death, the assets are distributed to the trust’s beneficiaries without going through probate. The grantor can also keep control of the assets and make changes to the trust as needed during their lifetime.

- Joint Ownership: When assets are held jointly with rights of survivorship, the surviving owner automatically inherits the deceased’s share without the need for probate. This method is frequently used with real estate, bank accounts, and other valuable assets.

- Beneficiary Designations: Some assets, such as life insurance policies, retirement accounts, and payable-on-death bank accounts, allow the account holder to directly designate beneficiaries. Upon the death of the account holder, the assets are transferred to the designated beneficiaries without the need for probate.

- Gifts: Individuals can reduce the size of their probate estate by making gifts to their beneficiaries during their lifetime. When the individual dies, the assets are no longer part of the probate estate.

- Estate Planning: Proper estate planning is critical for minimizing probate-related issues. Making a comprehensive and valid will or establishing a living trust can aid in the smooth transfer of assets after death. Individuals can avoid the probate process entirely by properly structuring their estate plans.

In Conclusion, while the probate process ensures the orderly transfer of assets, it can be a time-consuming and costly procedure. By employing effective probate avoidance techniques, individuals can streamline the estate transfer process, reduce costs, and potentially provide more privacy for their beneficiaries. It is crucial to consult with an experienced estate planning attorney to determine the most appropriate probate avoidance strategies based on individual circumstances and jurisdictional requirements.

References:

- “Nigeria: Overview Of Probate Laws And Probate Registry In Nigeria”. Mondaq, accessed 29th July 2023.

- “PROCEDURE FOR GRANT OF PROBATE IN NIGERIA”. Resolution Law Firm, accessed 30th July 2023.

- “Probate Avoidance Techniques”. Estate Planning Centers, accessed 31st July 2023.

- “10 tips to avoid probate”. Legal Zoom, accessed 1st August 2023.

- “Wills: Probate and Public Record”. Investopedia, accessed 2nd August 2023.

- “What is Probate & How to Avoid It”. Trust & Will, accessed 3rd August 2023.

Inflation rate: Nigeria doing better than other African countries – CBN

The Central Bank of Nigeria, CBN said the country’s inflation rate is still doing better than most African nations.

READ MORE

Nigeria, Ireland To Host Trade And Investment Conference On Agriculture

A group of professionals and policymakers from Nigeria and Ireland have partnered to hold a three-day partnership investment conference for development and growth from 27th to 29th October 2023 in Dublin.

READ MORE

GSK: Experts fear more coys may exit Nigeria

Operators have expressed fears of more foreign companies leaving the country, following the recent announcement of GlaxoSmithKline Consumer Nigeria Plc to shut down its operations in the Nigeria.

READ MORE

Inflation rate: Nigeria doing better than other African countries – CBN

The Central Bank of Nigeria, CBN said the country’s inflation rate is still doing better than most African nations.

READ MORE